Loanable Funds Graph Savings

Loanable Funds Graph Savings. Q* quantity of loanable funds. Using the loanable funds theory, show in a graph how the following events will affect the supply. The increase in deficit causes the interest rate i. The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air. In economics, the loanable funds doctrine is a theory of the market interest rate. Graphs 2 know for the ap econ exam. Brings private lenders and borrowers together. A high level of savings means more sources of loanable funds in the country. Ap macroeconomics released 2009 question.

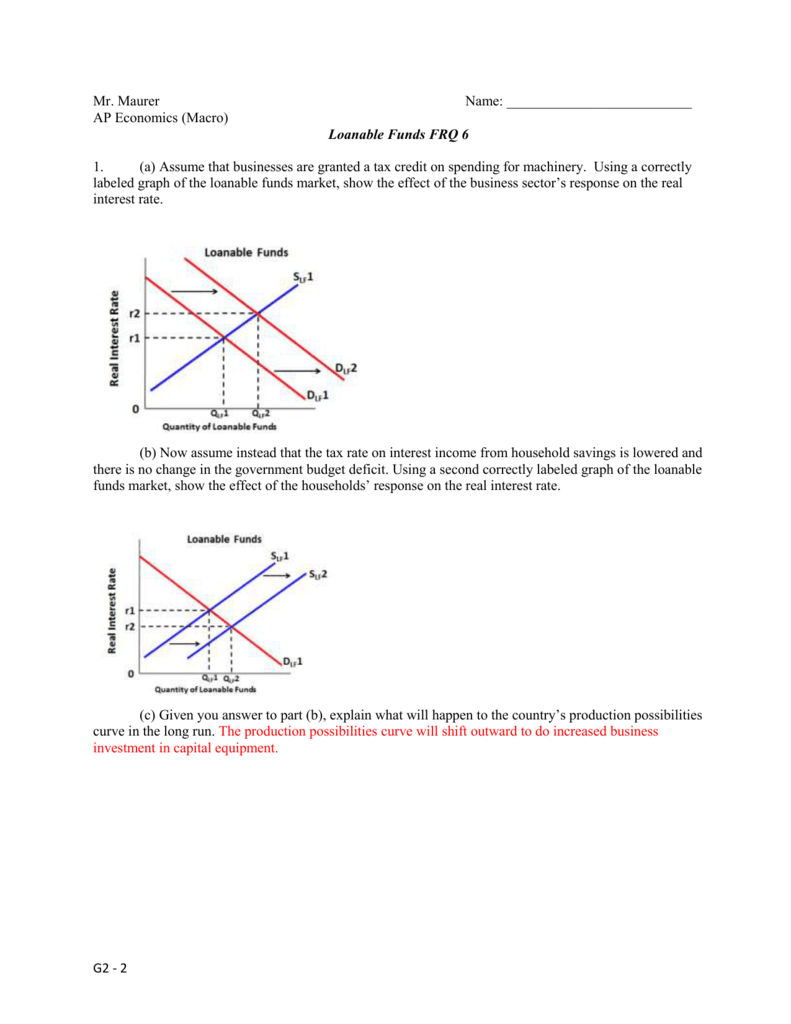

In economics, the loanable funds doctrine is a theory of the market interest rate. Anything else that causes consumers to save more or less of their income 2. The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital. In a few words, this market is a simplified view of the financial system. · this is what is known as the loanable funds graph or the loanable funds market (the amount of money used in savings and investment for an economy) · the savings or supply is private and public savings….private is ms.

But before representing it we will define some concepts well

The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. Use chrome or safari to move or draw graphs with your finger. When savings are supplemented with hoardings and bank credit, the sum total is referred to as loanable funds. The loanable funds market is used to show the effect of changes in interest rates in the private markets. (a) using a correctly labeled graph of the loanable funds market, show how a decision by households to increase savings for retirement will affect the real. Anything else that causes consumers to save more or less of their income 2. It represents the total loanable funds provided by the domestic economy. Crowding out r loanable funds d lf s lf r 0 lf 0 s lf 1 r 1 lf 1 government borrows more, reducing savings available for private uses. But before representing it we will define some concepts well Ap macroeconomics released 2009 question. This term is also synonymous with gross national savings or domestic national saving is an indicator of the health of a country's investment.

Also, everyone looking for a loan (either to spend it or to invest it) comes to this market. The equilibrium interest rate represents the point in which the supply and demand intersect, but this can be skewed by a single large borrower under a phenomenon called crowding out. The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital. Loanable funds are made up of the savings of those people or companies that are willing to lend that money and those who want to borrow. Q* quantity of loanable funds. The loanable funds doctrine extends the classical theory, which determined the interest rate solely by savings and investment, in that it adds bank credit. The market for loanable funds (3).

Tutorial on the loanable funds graph, change in real interest rates.

Ap macroeconomics released 2009 question. The demand for loanable funds is determined by the amount that consumers and firms desire to invest. Keeping in mind the fisher equation, click on the time period during which. The private component of the money market. (a) using a correctly labeled graph of the loanable funds market, show how a decision by households to increase savings for retirement will affect the real. Graph of lf market r loanable funds investment saving r 0 lf 0. The private sector loanable funds market. For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy. Retirement accounts, stocks, bonds and mutual funds. Graphs 2 know for the ap econ exam. Drag the yellow rectangles to move the lines on the graphs.

Determinants of loanable funds supply: Anything else that causes consumers to save more or less of their income 2. The market of loanable funds can be represented by a simple graph of supply and demand. It represents the total loanable funds provided by the domestic economy. Drag the yellow rectangles to move the lines on the graphs. Nominal interest rate and real interest rate between 1965 and 2015. Matches money of private savers with borrowers for investment or consumption. Keeping in mind the fisher equation, click on the time period during which. Using the loanable funds theory, show in a graph how the following events will affect the supply. The loanable funds doctrine extends the classical theory, which determined the interest rate solely by savings and investment, in that it adds bank credit.

The market for loanable funds.

Tutorial on the loanable funds graph, change in real interest rates. Ap macroeconomics released 2009 question. Graph of lf market r loanable funds investment saving r 0 lf 0. The increase in deficit causes the interest rate i. The market for loanable funds (3). The market of loanable funds can be represented by a simple graph of supply and demand. The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital. Loanable funds consist of household savings and/or bank loans. Crowding out r loanable funds d lf s lf r 0 lf 0 s lf 1 r 1 lf 1 government borrows more, reducing savings available for private uses. Keeping in mind the fisher equation, click on the time period during which. The loanable funds market is used to show the effect of changes in interest rates in the private markets. In general, higher interest rates make the lending option more attractive.

Saving is income not spent on consumption loanable funds graph. Supply and demand for loanable funds the follow.

Source: slideplayer.com

Source: slideplayer.com In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk The market for loanable funds.

Source: files.taxfoundation.org

Source: files.taxfoundation.org The equilibrium interest rate represents the point in which the supply and demand intersect, but this can be skewed by a single large borrower under a phenomenon called crowding out.

Source: i.stack.imgur.com

Source: i.stack.imgur.com The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air.

Source: crimfi.files.wordpress.com

Source: crimfi.files.wordpress.com Using the loanable funds theory, show in a graph how the following events will affect the supply.

Source: college.cengage.com

Source: college.cengage.com But before representing it we will define some concepts well

Source: www.econlowdown.org

Source: www.econlowdown.org Similarly, loanable funds are demanded not for investment alone but for hoarding and consumption purposes.

Interest rates are important in explaining economic activity.

Source: i.ytimg.com

Source: i.ytimg.com Above the equilibrium interest rate, the quantity of loanable the graph depicts the u.s.

The term loanable funds is used to describe funds that are available for borrowing.

Source: econ101help.com

Source: econ101help.com Determinants of loanable funds supply:

Source: i.ytimg.com

Source: i.ytimg.com In general, higher interest rates make the lending option more attractive.

The loanable funds theory analyzes the effect of supply and demand on the loanable funds market.

Source: s3-us-west-2.amazonaws.com

Source: s3-us-west-2.amazonaws.com Retirement accounts, stocks, bonds and mutual funds.

Source: econ101help.com

Source: econ101help.com The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air.

Source: files.taxfoundation.org

Source: files.taxfoundation.org Nominal interest rate and real interest rate between 1965 and 2015.

Source: cf2.ppt-online.org

Source: cf2.ppt-online.org Using the loanable funds theory, show in a graph how the following events will affect the supply.

Source: upload.wikimedia.org

Source: upload.wikimedia.org In general, higher interest rates make the lending option more attractive.

Source: 14yagnvi.files.wordpress.com

Source: 14yagnvi.files.wordpress.com Other big sources of households' savings are:

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com Brings private lenders and borrowers together.

Source: www.reviewecon.com

Source: www.reviewecon.com Every graph used in ap macroeconomics.

The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org Every graph used in ap macroeconomics.

Every graph used in ap macroeconomics.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net Graph of lf market r loanable funds investment saving r 0 lf 0.

Source: files.taxfoundation.org

Source: files.taxfoundation.org Determinants of loanable funds supply:

Source: imgv2-2-f.scribdassets.com

Source: imgv2-2-f.scribdassets.com In a few words, this market is a simplified view of the financial system.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Brings private lenders and borrowers together.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Supply and demand for loanable funds the follow.

Source: www.reviewecon.com

Source: www.reviewecon.com The graph should look exactly like that for.

Source: www.coursehero.com

Source: www.coursehero.com Because investment in new capital goods is frequently made with loanable funds, the demand and supply of capital is often discussed in terms of.

Source: s3.studylib.net

Source: s3.studylib.net It represents the total loanable funds provided by the domestic economy.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com (a) using a correctly labeled graph of the loanable funds market, show how a decision by households to increase savings for retirement will affect the real.

Posting Komentar untuk "Loanable Funds Graph Savings"